property tax on leased car massachusetts

Property Tax On Leased Car In Ma PRFRTY. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment.

Who Pays The Personal Property Tax On A Leased Car

This would apply whether you own or lease.

. Leasing a car usually costs less than financing one. Excise taxes in Maine Massachusetts and Rhode Island. Your cars worth will be taxed at 25 per 1000 dollars.

Taxes are paid on motor vehicles every year based on their price. Leasing A Car Is A Bad Financial Move For College Students. Excise tax is assessed from the time the vehicle is registered at the RMV.

The use tax applies to all other types of transfers of title or possession where the vehicle transferred is stored used or consumed in Massachusetts. This could include a car which in most households is a relatively valuable property. The tax is levied as a flat percentage of the value and it varies by county.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Property Tax On Leased Car In Ma. In the fifth and all succeeding years.

And motor vehicle registration fees in New Hampshire. A capitalized cost reduction and. The excise tax rate is 25 per 1000 of assessed value.

To learn more see a full list of taxable and tax-exempt items. This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. If personal property taxes are in effect you must file a return and declare all nonexempt property as well as its value.

You pay an excise instead of a personal property tax. CONNECTICUT Connecticut car owners including leasing companies are liable for local property taxes. How is Excise Tax determined for the state of Massachusetts.

The sales price of motor vehicle lease payments properly included personal property tax charged to the lessee by the lessor for rhode island sales and use tax purposes. Now that same lease assuming you got the Honda Accord with a 15 markup translates to 535month using the most up to date rates and. You will have to pay personal property taxes on any vehicle you do not register.

If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and. There is an excise tax instead of a personal property tax.

Although the lease agreement and state laws govern when you will owe any personal property tax on your leased vehicle and when it must be paid. Massachusetts New and Used Car Sales Tax. This would apply whether you own or lease.

Directives 2 3 and 4 below also apply to rentals of motor vehicles for a. Property taxes on the vehicle are not applicable for the lessee. The excise rate is 25 per 1000 of your vehicles value.

Massachusetts levies an excise tax on all retail sales of tangible personal property and telecommunications services in Massachusetts by a seller unless otherwise specified. They are not subject to local taxes in New Jersey New York and Vermont. The payments are lower because youre only paying for the cars loss in value plus lease fees.

This means that if you purchase a vehicle that costs 15000 but receive a 2000 rebate you will only be taxed for 13000 of the total vehicle price. In Massachusetts you can deduct the Motor Vehicle Excise Tax you paid on your vehicles. You have a 3 year lease on a car with an msrp of 20000 and a 50 residual.

64I the Departments sales tax regulation on Discounts Coupons and Rebates 830 CMR 64H14 and Motor Vehicles 830 CMR 64H251 to motor vehicle leases. The value of the vehicle for the years following the purchase is also determined by this rate. Every motor vehicle is subject to taxation either as excise or personal property tax for.

Leasing A Car Is A Bad Financial Move For College Students. DD 04-3 updates and clarifies the application of the sales and use tax statutes GL. The definition of sale includes any transfer of ownership or possession or both in return including the rental or leasing of tangible personal property.

Do You Have To Pay Property Tax On A Car In Massachusetts. For example On a 27000 Honda Accord that means 270month with 1350 due at start. Youll have to pay upfront lease costs which usually include.

The minimum excise tax bill is 5. In the fourth year. The state-wide tax rate is 025 per 1000.

Your first months payment. In the third year. For example in Alexandria Virginia a car tax runs 5.

When you lease a car you dont have to worry about the car losing value. Sales and Use Tax Introduction. A good lease a few years ago would be about 1 of the MSRP per month with 5 due at signing for the feesfirst payment.

Property tax on leased car in ma. Most companies set a limit of 12000-15000 miles every year. They are just different ways of financing.

While massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The ongoing costs of a vehicle lease are the monthly payments vehicle insurance repairs and maintenance personal property taxes where applicable and registration and inspection fees. Taxes registration fees and other dealer fees.

You will have to pay personal property taxes on any vehicle you do not register.

Ma Property Taxes Bill Could Require Harvard Mit To Pay More

Property Tax Volvo Ma Ask The Hackrs Forum Leasehackr

Massachusetts Auto Sales Tax Everything You Need To Know

Excise Tax What It Is How It S Calculated

Who Pays Personal Property Taxes On Leased Vehicles In Missouri Slfp

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Lease Buyout Guide To Buying Out Your Car Lease Lopriore Insurance Agency

Which U S States Charge Property Taxes For Cars Mansion Global

Who Pays The Personal Property Tax On A Leased Car

Lease Return Center Boch Toyota South

Failed Inspection Lemon Law Mass Gov

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

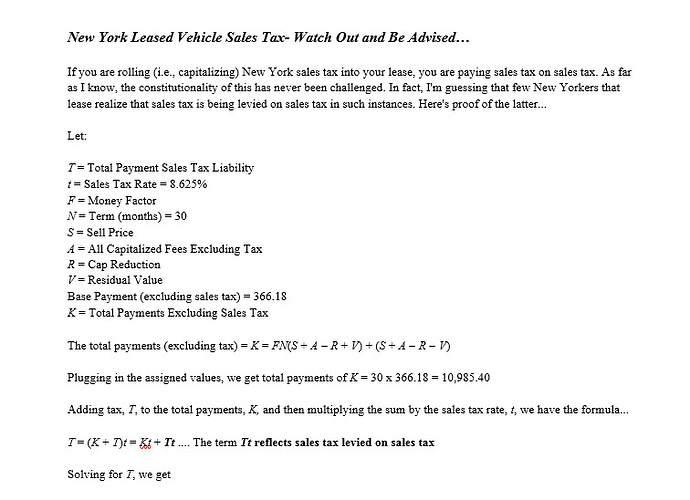

Sales Tax In Ny Off Ramp Forum Leasehackr

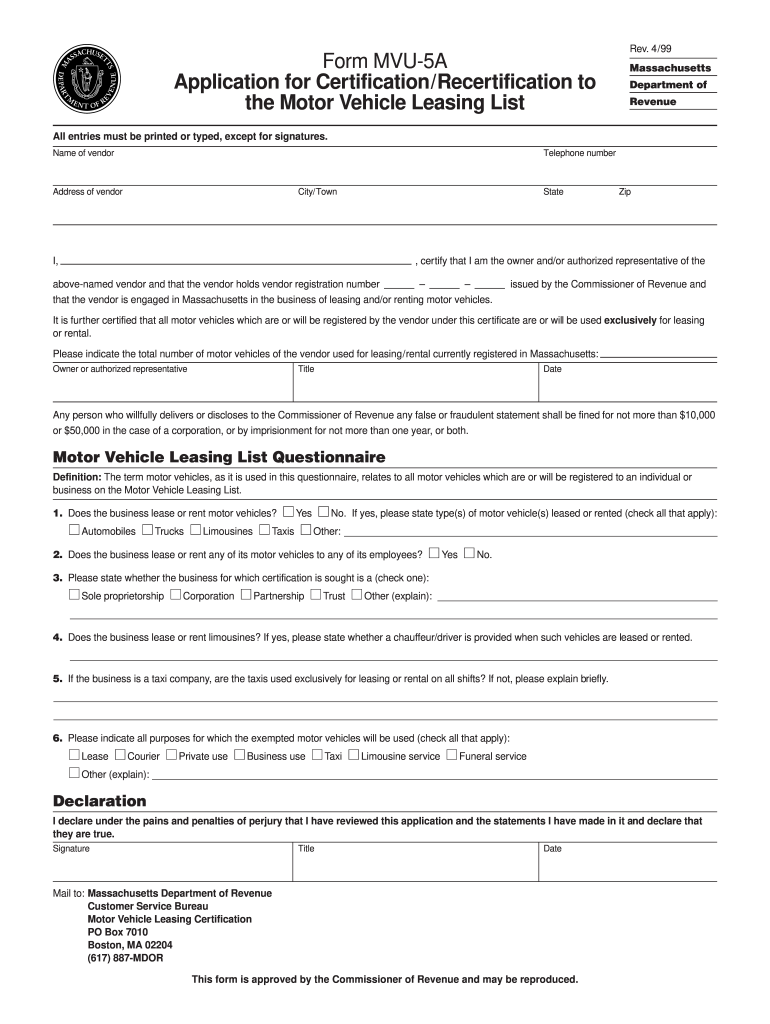

Ma Mvu 5a 1999 2022 Fill Out Tax Template Online Us Legal Forms

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price